Revolutionising Cash On Delivery

A Blueprint for a Transition to Digital Payments in Pakistan's eCommerce Landscape

This article aims to share my ideas on how logistics companies and eCommerce companies could go about digitising and converting their Cash On Delivery (COD) customers towards prepayment methods.

How big is COD in Pakistan and why?

Cash on delivery is the default mode of payment for the majority of physical eCommerce transactions in Pakistan, and even though digital transactions in Pakistan have been on the rise; and they may cross cash withdrawals in the next 12 months. COD transactions constitute a substantial portion, estimated at 60-70% of the total market size.

Despite being the primary payment method cash on delivery is an expensive option for merchants, due to delayed cash flow and additional delivery charges for the risks associated with the delivery due to high refusal rates. Cash on Delivery can end up costing merchants more money in the long term. (we created a COD calculator exploring these costs in one of our previous articles)

Cash on delivery is the default option used by the majority of customers becuase of a lack of trust. A survey conducted three years ago revealed that 79% of online shoppers in Pakistan preferred COD, citing trust as the primary factor and access to a non-cash payment method second (33%). Overcoming this trust deficit is crucial for encouraging customers to embrace prepayment methods.

What can be done to solve it?

Today, there are two solutions that are addressing this problem:

Small merchants who use their own delivery riders can send a Point of Sale (PoS) device with their riders to the customers house. This works with both food delivery and electronics merchants.

Trax created an option for payment while out for delivery earlier this year, intially with 1Link and then expanded to PayFast. Link

Pilot Program

Karandaaz launched a program in the last week to speed up this process (I was part of the team that suggestested this idea). The program is designed to incentivise delivery companies to offer customers the ability to pay digitally for cash on delivery orders. Its a great opportunity for any logistics company to test and build out a unique solution.

The program was launched last week and will close for submissions on December the 26th.

Building a Solution

The purpose of this article is to look at building a better way to convert COD customers towards prepayment and solving for the existing trust deficit. The success of the program will depend on the following assumptions that we are making on behalf of the stakehoders:

Point of Payment Collection

The model we have designed assumes that the customer has placed an order via COD and the logistics company that is making the delivery will attempt to collect the funds digitally.

A system where the customer chooses Payment on Delivery at the time of checkout, can also be designed but requires some modification to the models below and further customisation on the merchants website so we have decided to not fous on that particular scenario for now.

To start off with we have to decide when to collect payment from the customer. There are 3 points at which the payment could be collected:

Payment Before Delivery (PBD)

Payment During Delivery (PDD)

Payment After Delivery (PAD)

When people think of digitising cash on delivery the general consensus would be that payment should happen at the time of delivery, however, we feel that we should encourage Payment Before Delivery (PBD) as much as possible. The benefits to this are manifold in terms of effeciency and cost from the perspective of the logistics company and should be incentivised for the customer as well. However, this will require building trust with the customer.

There is then the option of Payment During Delivery (PDD) and finally the unlikely option of Payment After Delivery (PAD).

Payment Before Delivery

This journey begins when the 3PL receives the parcel and has an estimated delivery date & time. At that point the 3PL will message the customer saying their have recieved the parcel along with a link to make the payment in advance.

The payment link option requires the customer to go to specific webpage where their total payment amount is already present and pay via any of the payment methods that are available. It would be similar to placing an order online. What will be key however, is that the 3PLs backend system then needs to ensure that the COD amount for the parcel in question is reset to 0, otherwise when the delivery rider is out on his delivery run he will require payment which will very rightly so turn into a bit of a customer service nightmare.

Another key factor will be when this payment link will expire, to mitigate the chance of a double collection at the time of delivery as well.

We feel that Payment Before Delivery is the best option for 3PLs as it will greatly reduce the time it takes for a parcel to be delivered. COD parcels delivery on average take from 8-12 minutes, while non-COD parcel’s delivery take as little as 2-5 minutes, resulting in greater effeciency and lower costs.

The two biggest factors that will determine the success of this method is the clarity by which communication is done to customers and if incentives are provided for early payment.

Another option is if the the 3PL offers customers the ability to at their retail locations close to the customer via OTC payments.

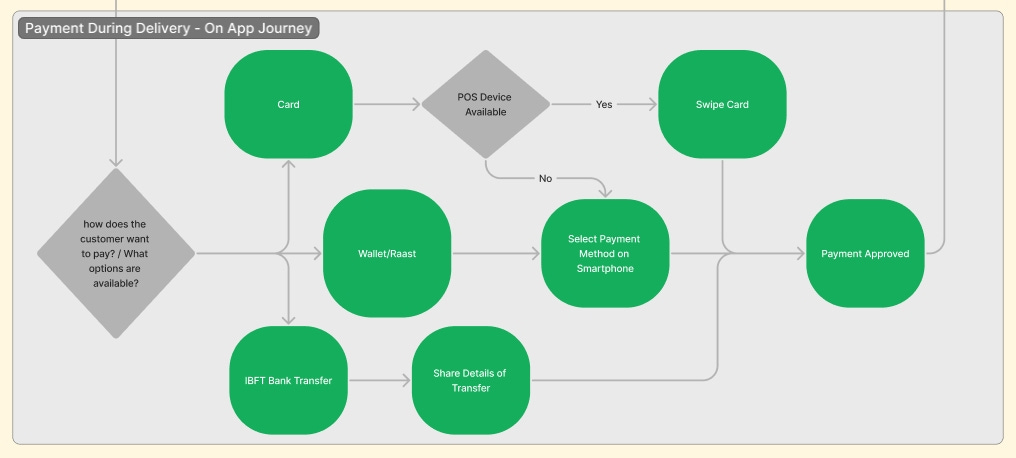

Payment During Delivery

We expect that during the intial stages of this model, customers are unlikely to pay in advance, so our methodology for collecting at the time of delivery has to be seamless from a user experience point of view, as if its not, the level of frustration that will be built on both the customers and the riders side will result in this method not being a success.

There are means of ensuring this happens, by prepping the customer prior to the delivery attempt, saving key customer information etc, however, we will not be going into depth on that front, instead just looking at the basic journey that a customer and the delivery rider will go through. The training and scripts provided to the delivery riders during this period will also be critical success factor.

This system will work best if each rider has a smartphone and an active internet connection. The other key consideration is whether the rider will have a POS device or dongle where they can swipe a customer card at the time of delivery.

On App Journey

If the customer has agreed to pay digitally the customer can then be told their payment options (we will discuss the benefits of each option later). The riders smartphone will be key in then processing the transcation and ensuring the funds have been recieved before handing over the parcel.

Payment After Delivery

While this is technically an option and would work similar to the Payment Before Delivery, given the unlikelihood of it being adopted or even succeeding we shall not explore further.

Types of Payment Methods

There are various payment methods that could be offered to customers, and it would be best to offer as many as possible to increase options for customers. These range from:

Card payments, for debit and credit cards

Wallet payments, with EasyPaisa & JazzCash being the largest,

Direct Bank Transfer either connected via Raast or direct API with the banks, and

IBFT which the customer would do on the spot.

All except the last one are preferred as they would give instant feedback to the courier on payment recipt and be comparatively fast which is crucial especially at the Payment At Delivery point. IBFT would end up being the slowest method and would also cause reconcialiation challenges with the merchants.

The 3PL would need to ensure they choose payment gateways that offer these payment options, or integrate multiple gateways. It is important to consider redundancy options where possible.

Payback to Merchants

The critical elements to the success of this program is how effectively the payout mechanism is designed, the charges for this delivery method, and how quickly payments can be made to merchants.

Logistics companies may even be able to generate additional business volumes as payments from customers could directly be sent to merchants making their reconciliation easier and offering their merchants the fastest payback in the industry.

Conclusions

The above is quick attempt to look at the ways in which digitising COD may help reduce the trust defecit that is apparent in the eCommerce market and help us towards reducing our reliance on Cash on Delivery.